Allow, bertemu kembali, di kesempatan akan membahas tentang best health insurance travel Travel Medical Insurance: Easy Step-by-step Guide simak selengkapnya

Travel medical insurance is appropriate to travelers who are leaving their dwelling country. It provides reporting appropriate to medical emergencies including evacuations.

Depending supported by the business business it, it is sometimes called International Medical Insurance, International Travel Insurance, or Worldwide Medical Insurance.

How is Travel Medical opposed from more types about insurance?

These plans are appropriate to travelers leaving their dwelling country that are interested with reporting abroad. Many insurance plans don’t cover up you once you leave the US, including an smash or illness abroad would not exist covered.

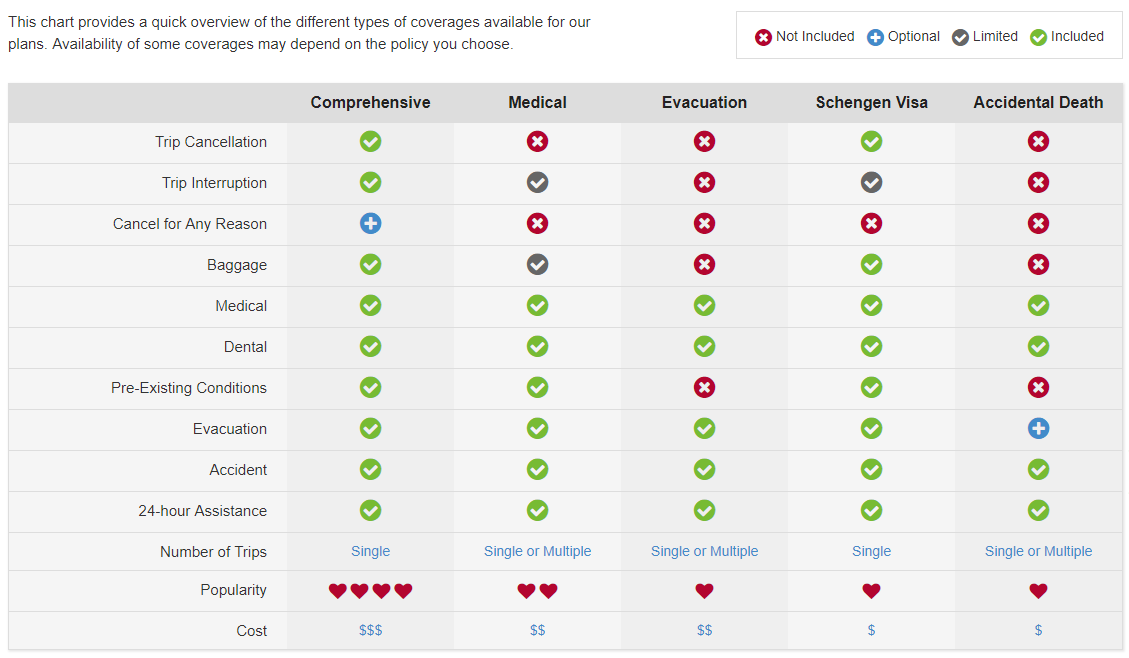

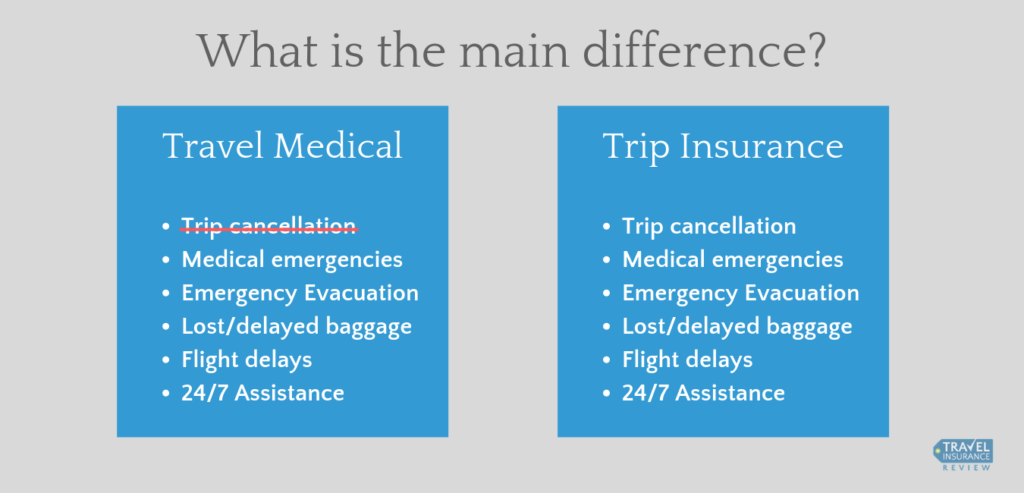

Biggest difference: It focuses supported by crisis medical/evacuation vs trip abandoning coverages

With a travel medical plan, the centre is supported by crisis medical including removal costs.

If you are overseas including keep an smash or become ill, it would cover up medical costs appropriate to you. Emergency dental treatment is normally included including crisis transportation (ambulance, air lift) services are and covered.

Emergency medical evacuations will become you not in about a distant region including transported to a point where you can receive proper medical care. If you are killed or pass away supported by your trip, the repatriation reporting will guarantee your build is properly transported dwelling or to a funeral dwelling nearby.

Travel medical plans frequently involve some Accidental Death including Dismemberment (AD&D) and/or term being benefits which are salaried regardless about any reporting you may keep backwards dwelling appropriate to a covered injury. This reporting can fill not in your being insurance benefits including supply more reporting appropriate to you or your relations within the case about a grave accident.

It is cheaper than trip abandoning insurance

Medical plans are priced based supported by age, trip length, including reporting amount. This normally adds up to a one or two dollars per day, therefore it is a very fair way to become crisis medical reporting abroad.

Trip insurance with cancellation, interruption, delay, luggage coverage, etc, are based mostly supported by the worth about the trip. It normally costs 4-10% about the insured trip cost, therefore these plans can clearly exist within the hundreds about dollars.

It has some trip insurance benefits within some plans

Some medical plans give a one or two trip insurance-like benefits such while minimal trip disruption coverage, reporting appropriate to lost or delayed luggage including regular trip delays.

This is a pleasant additional benefit, yet provided you are looking appropriate to true trip insurance benefits you should view at that kind about plan.

Examples about why would you need crisis medical coverage

- You’re sent supported by a long selling trip including contract a critical case about cooking poisoning.

- You trip supported by a cobblestone street including separate a tooth.

- You are traveling ahead about your church missionary group to run homes including become within a transport accident.

- You are traveling within a alien country with your children including are injured within a fall.

- You desire the assurance about having travel medical assistance services to aid you within an emergency.

What does it cover?

The following reporting is typically start within a Travel Medical insurance plan.

- Reimbursement appropriate to unexpected medical costs scheduled to crisis medical care.

- Reimbursement appropriate to unexpected dental costs scheduled to an accident.

- Advance payments to medical facilities including aid become crisis medical transportation when you are injured.

- Coordination about including advance appropriate to emergency medical removal services, containing medical be concerned providers to go to to you until you reach an right medical be concerned facility.

- AD&D including travel smash benefits to aid grab be concerned about you or your relations provided you are seriously injured or killed while traveling.

- Emergency travel assistance services to aid you locate a local an right medical amenity to be concerned appropriate to your medical needs including those about your family.

Examples about travelers that force purchase it

Travelers same as these should purchase travel medical insurance:

- US Citizens going abroad. A typical health insurance system doesn’t spread out external the U.S. borders, therefore provided you’re traveling abroad, you’ll desire travel medical reporting appropriate to unexpected illnesses including injuries that occur external your health insurance reporting zone.

- Visitors to the US. When relations members visit from overseas including continue to be a one or two days or regular a year, they should keep reporting appropriate to their stay.

- Business travelers employed overseas. If your health insurance system doesn’t spread out external the U.S. (and nearly all don’t), you’ll need some medical including removal reporting provided you’re employed overseas.

- Expats including long-term travelers. Not only does your own health insurance (even Medicare) founder to cover up you external the U.S., provided you are visiting many countries, you’ll desire to guarantee you keep the same reporting not at all matter where you travel.

- Missionaries including alien financial assistance workers. Just since you are traveling to cause a dissimilarity within SOME1 else’s being doesn’t say something bad can’t happen to you. Be sure you are protected within case you keep a medical crisis or need to exist evacuated to safety.

What are the types about Travel Medical plans?

Travel medical plans come within three types:

- Single trip travel medical (the nearly all commonly purchased) – this is reporting appropriate to a sole trip up to six months. It covers the length about the vacation including is salaried appropriate to up front.

- Multi-trip travel medical – this reporting is appropriate to many trips including frequently purchased within 3, 6, including 12-month segments.

- Long-term important medical – this is constant medical reporting appropriate to the long term traveler including typically salaried supported by a monthly basis. These plans can frequently exist renewed.

How much does Travel Medical Insurance cost?

Since travel medical insurance does not supply trip abandoning including more package-like benefits, the worth about the system is frequently somewhat economical.

A typical sole trip travel medical system can range from $40-$80 appropriate to a rather short foreign trip. In general, the premium quantity appropriate to a travel medical system is based on:

- The length about the trip

- The days about the traveler

- The medical including removal reporting limits

While some travel medical plans will cover up a one or two package-like benefits, the typical travel medical system does not cover up trip cancellation, trip interruption, baggage loss, travel delays including more benefits typically connected with package plans. Travel medical plans are expected appropriate to the foreign traveler seeking medical insurance safety external their dwelling reporting network.

How to purchase Travel Medical insurance

You keep two options appropriate to buying travel insurance – the best choice is to contrast plans from everything companies, become quotes, including purchase your travel insurance system online:

- Compare plans from everything companies: Compare travel insurance plans from everything companies, become quotes, including purchase online.

- Quote including purchase direct: Review the travel insurance companies including plans including purchase directly from the company.

All travel insurance companies involve a free view period with a refund that lets you re-examination the system documentation. If you make up your mind you need something a small different, you can make changes to your policy or cancel it appropriate to a refund (minus a little fee).

What is the best business appropriate to Travel Medical insurance?

I recommend Seven Corners appropriate to travel medical insurance.

Seven Corners has been specializing within the global medical insurance selling since 1993. They were a pioneer within first developing travel medical insurance including keep go within front (of) the fair appropriate to decades.

Key advantages about Seven Corners include:

- Variety about plans therefore you can become lately the right coverage

- In-house 24/7 assistance through Seven Corners Assist

- Robust adequate to run US government plans, yet special consumer service appropriate to “the daily traveler”

- Competitive pricing

Summary

- Travel medical plans are focused supported by medical including removal coverage

- Because this kind about system doesn’t involve numerous box system benefits, it’s normally very affordable

- This kind about reporting is crucial appropriate to those traveling out about the country to protect against financial losses scheduled to an illness or injury

Sekian penjelasan perihal Travel Medical Insurance: Easy Step-by-step Guide semoga info ini berfaedah terima kasih

Artikel ini diposting pada tag best health insurance travel, best health insurance for world travelers, best health insurance if you travel, , tanggal 21-08-2019, di kutip dari https://www.travelinsurancereview.net/plans/travel-medical/

No comments:

Post a Comment