Hi, selamat malam, sesi kali ini akan dibahas tentang health insurance 30 day waiting period Sequis Q Health Platinum Plus Rider - Sequis simak selengkapnya

Sequis Q Health Platinum Plus Rider

Health cost in Indonesia increases up to 36% annually (source: kompas.com, 02/02/2017). We can never predict the amount of cost we need to pay for our health treatment if we are sick. However with health insurance, we can be protected up to certain value that will ease the cost. Sequis presents Sequis Q Health Platinum Plus Rider, a health insurance protection that will help you access the best treatment in selected hospitals. Add/activate this rider to your basic insurance for your 24-hours and 365-day protection in a year in several countries in Asia with a medical treatment comfort on your hands.

Benefit

-

Health protection up to 85 years old.

-

Provides accidental death benefits.

-

Provides additional benefits of cancer and heart attack.

-

Provides inpatient benefits with a minimal of 6 hours of care.

-

Provides health care benefits according to the bills and plan taken.

-

Cashless facilities in more than 500 hospitals in Indonesia and Malaysia.

-

Provides health services in Southeast Asia kawasan (Brunei Darussalam, Philippines, Indonesia, Cambodia, Laos, Malaysia, Myanmar, Singapore, Timor Leste, Thailand, and Vietnam), China (including Hong Kong), India and Sri Lanka.

-

Travel assistance and emergency treatment services.

-

Provides facilities that can be used by customers:

Free Look Period Grace Period Policy Reinstatement

![]()

Entry Age

• Minimum 1 (one) month • Maximum 65 years old • Renewal can be extended up to the Insured’s attained age 85

![]()

Premium Payment Period

Every year up to the Insured’s attained age 85

![]()

Coverage Period

Yearly Renewable Term up to the nearest policy anniversary with the Insured’s age 85

![]()

Maximum Coverage Age

Up to the Insured’s attained age 85

![]()

Sum Assured

For SequislinQ Protector Plus Unit Link basic product, minimal Sum Assured is: • Rp100,000,000 (Plan 400 – 1000); • Rp200,000,000 (Plan 1250 – 2000); • and Rp300,000,000 (Plan 2500 & 3000).

![]()

Mode of Payment

Monthly, Quarterly, Semesterly, or Yearly

![]()

Waiting Period

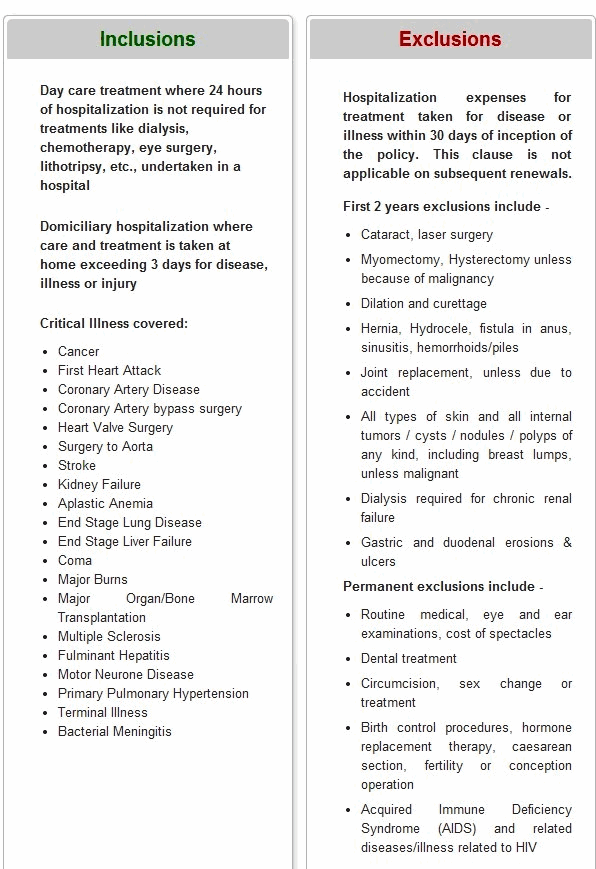

• All medical or physical conditions that occur or begin within 30 calendar days of waiting period and/or certain diseases that occur or begin within 12 months of waiting period, except as a result of injury.

![]()

Waiting Period

• Additional benefits for cancer/heart attack will be paid if the Insured suffers from cancer/heart attack after passing the waiting period of 90 calendar days.

![]()

![]()

Distribution Channel

Sequis Agents

![]()

Age Calculation Method

Nearest birthday

* The clause that provides restrictions on any of the insurance benefits within a certain period during the Policy is still valid

If you are interested and would like to know more about Sequis products and services, please contact Sequis Care through (62-21) 2994 2929 on business days at 08.15 am to 5 pm or by email to care@sequislife.com.

This product is managed by PT Asuransi Jiwa Sequis Life

Sekian pembahasan perihal Sequis Q Health Platinum Plus Rider - Sequis semoga artikel ini bermanfaat salam

tulisan ini diposting pada kategori , tanggal 26-08-2019, di kutip dari https://www.sequis.co.id/en/health-insurance/individual/health/health-hospitalization-insurance/Sequis-Q-Health-Platinum-Plus-Rider

No comments:

Post a Comment