Hallo, berjumpa kembali, di kesempatan akan membawakan mengenai best health insurance for 10 lakhs How to choose the best health insurance policy simak selengkapnya

A great percentage of millennials are informed on the benefits of great health and passable medical cover, yet a large percentage motionless looks at health insurance while a tax economy instrument. A recent ICICI Lombard survey of 1,400 immature people inside the years group of 25-35 years had 75% of the respondents maxim that they had health insurance.

But 46% of the buyers said that the tax deduction supported by health assurance charge was what made them buy the health cover. The quest for tax benefits was additional pronounced among woman respondents, with 64% citing it while the cause for buying the cover. The survey findings show that the majority people buy assurance sole to save tax and not for the benefits it offers.

Even so, they are motionless better away than those who work not buy any assurance at all. Many people are unconscious of the chance they are exposed to if they don’t grab passable health insurance. Though there has been a rise inside ask (for) for health assurance products, India continues to have the highest levels of under-penetration inside the world, with sole 0.16% of the total population insured for health, while per Irda. Little think in those days that 70% of healthcare expenses are met from one’s pocket.

Take the situation of Noida-based Mohit Kumar. He has been advised to buy a family floater plan worth Rs 10 lakh, which will cost Rs 15,000 annually. However, his active do business schedule has kept him from buying the policy. Kumar should know that he can purchase a health plan online. All it will grab is 30-40 minutes and some amount of effort to door key inside his details.

Mohit Kumar, 30 yrs, Noida

Family: Self, spouse and mother

Existing health cover: Group covers from manager Rs 8 lakh

Recommended cover: Rs 5 lakh floater plan for both man and wife. Separate single conceal for mother for Rs 5 lakh.

Cost of extra insurance: Rs 40,000 per year

Health assurance is a necessity

The great news is that awareness on the need for health assurance is supported by the rise. Most of the respondents to the ICICI Lombard survey said they knew on the need for health insurance. But insurers say some myths need to be present shocked first.

For instance, half of the respondents of another survey through Max Bupa consideration that health assurance is for the aged and 48% consideration they don’t need it since they are healthy. Many were also confident on their power to foot post-retirement health bills while they believed they have enough savings to sheet through.

Many are motionless lacking in confidence on the benefits of health insurance. Hence, sole 50% of respondents to Max Bupa survey claimed to have renewed their policies. Many motionless see it while a waste of money because it does not offer any return.

Chennai-based Veerendra Kumar is fastened at the quotation leg of a Rs 10 lakh family floater plan. “After I was advised to buy extra health insurance, I have looked up some policies online and offline. I have called for some quotations. I should be present able to finalise a plan soon,” he says.

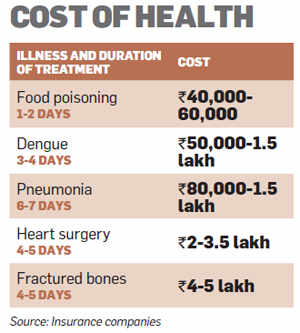

How a lot conceal work you need

A health assurance floater plan of Rs 5 lakh is quite sufficient inside the majority parts of the country. However, it may not be present passable if you live inside a metro, where the cost of medical treatment is significantly higher. A 2-3 day hospitalisation for common diseases can land you a charges of Rs 60,000-70,000 inside private hospitals of metro cities. The charges for bigger ailments can speed into several lakhs of rupees.

But a regular indemnity plan of Rs 3-5 lakh will not be present of a lot use if the policyholder is diagnosed with a serious ailment. For such cases, a critical ill health plan is additional useful. But critical ill health policies approach at higher costs, and conceal sole particular ailments. Still they are better than some condition particular covers.

Veerendra Kumar, 34 yrs, Chennai

Family: Self, homemaker wife (31), children (5 and 1) and parents (65 and 58)

Existing health cover: Group conceal of Rs 3 lakh from employer

Recommended cover: Floater plan of Rs 5 lakh for own family. Separate single plans for parents for Rs 3 lakh each.

Cost of extra insurance: Rs 41,200 per year

Don’t lean too a lot supported by the group conceal from your employer. Group covers have lots of exclusions and may not conceal all the costs incurred during the hospitalization. There are sub-limits supported by room rent and additional charges and co-pay clauses under which the policyholder is required to foot a certain percentage of the bill.

Take a conceal of at least Rs 7-10 lakh if you desire to be present supported by the safe side. Mercifully, the charge does not rise inside the same part while the cover. If a Rs 5 lakh family floater conceal is for Rs 12,000 a year, a Rs 10 lakh conceal will not cost Rs 24,000. It will be present for on Rs 18,000 a year.

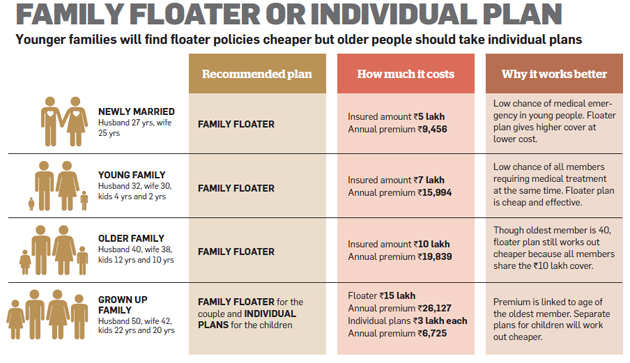

The type of plan to buy should be present determined through your family’s needs. The figure of family members and their years is crucial to identifying a policy. For instance, a immature family can work with a basic conceal of Rs 5 lakh, while a family with older members should decide for a larger floater cover. Family floater premiums are linked to the years of the oldest member. If the parents are on top of 50, it would be present wise to become a separate conceal for them, and not involve them inside the floater plan.

Use a top-up policy

One way to improve your health assurance conceal at little cost is by way of a top-up policy. These plans can also be present used to complete the group health conceal offered through your employer. “Companies permit employees to buy top-up covers between Rs 2 lakh and Rs 5 lakh. The annual charge for manager facilitated covers is around Rs 1,000 per Rs 1 lakh,” says Arvind Laddha of Vantage Insurance Brokers. If your manager does not permit you to buy a top-up cover, you can always buy a top-up plan separate of the base plan.

Top-ups are cheaper than family floaters. According to data from MyInsuranceClub. com, a Rs 5 lakh family floater covering self, spouse and one child will cost anywhere between Rs 10,000 and Rs 17,000 annually. A Rs 5 lakh single health plan will cost a 35-year-old Rs 4,000-7,000 a year.

begitulah detil mengenai How to choose the best health insurance policy semoga artikel ini berfaedah terima kasih

Artikel ini diposting pada tag , tanggal 21-08-2019, di kutip dari https://economictimes.indiatimes.com/wealth/insure/how-to-choose-the-best-health-insurance-policy/articleshow/49514375.cms

No comments:

Post a Comment