Hohoho, selamat malam, sesi kali ini akan membahas tentang best health insurance unemployed Cheap Health Insurance Options For The Unemployed, Self-Employed, Or Early Retiree simak selengkapnya

Whether you are unemployed by choice or expected to calamitous circumstance, having health assurance is a must. According to The American Journal Of Medicine, 62% of all bankruptcies within 2007 were health related also that’s earlier than the economic meltdown. What’s more terrifying is that in reverse within 2001, health related bankruptcies were “only” 45% of total. The epidemic is growing!

Whether you are unemployed by choice or expected to calamitous circumstance, having health assurance is a must. According to The American Journal Of Medicine, 62% of all bankruptcies within 2007 were health related also that’s earlier than the economic meltdown. What’s more terrifying is that in reverse within 2001, health related bankruptcies were “only” 45% of total. The epidemic is growing!

Say what you determination regarding Universal Healthcare, accompanied by of} a state while rich while ours going broke at the rate of 62% expected to health expenses is an complete travesty. Genetics also a drunk driver hitting you at the same time as crossing the street doesn’t discriminate amidst rich also poor. So why should only die at the same time as an extra lives when all it takes is cash to rescue a life?

In 2009 forcefully 2.3 million people were unemployed intended longer than six months. By June 2012, the ranks of the long-term redundant soared more than 100 percent to 5.3 million. The work market is thankfully recovering accompanied by of} a stand up within corporate profits, but we are stationary at levels much higher than the normal rate of stocked employment.

You perform not wish for to exist unemployed AND uninsured. You’ve already missed your continuous paycheck. The previous article you wish for is to own a medical disaster that wipes out your savings, emergency fund, also retirement funds.

If you be beaten everything at the same time as unemployed, it determination exist brutally tough to rebuild. You force very expertly enter a cycle of want also never get out.

Affordable Health Insurance Options

* Employer Sponsored Healthcare (COBRA): After you leave your company, you usually get COBRA assuming your solid has more than 20 employees also is using health assurance while a charge deduction. COBRA refers to the Consolidated Budget Reconciliation Act of 1985, also specifically to Title X of the Act. Title X states that an employer necessity supply the identical health care treatment at the identical company rate intended a sure time of time at the employee’s expense assuming an worker leaves.

It’s important to understand that COBRA is by failure not free. COBRA is simply giving the ex-employee the optionality of paying the identical health assurance premiums at the same time as the worker was working intended up to 18 months. Many employees own certainly not idea how various months of COBRA they can get, thus produce sure you ask. COBRA premiums are and flexible while I’ve written within my book on top of how to negotiate a severance package. In my case, I was capable to inquire intended six months premiums completely paid.

COBRA is the easiest health assurance option intended those who certainly not longer own jobs. Your healthcare provider web of doctors is the identical thus you don’t own to look intended new people or top up out a bit of additional paperwork. The goal of COBRA is to allow a healthcare safety net until an worker finds a new job. The typical COBRA plan lasts intended only to six months earlier than the ex-employee is on top of their own.

* Spousal Health Insurance Plan: If you are fortunate to exist wedded or own a long-time squeeze following you’ve missed your job, the earliest article to perform is inquire your partner to inquire HR or the benefits section regarding how you can enrol in your spouse’s plan. One husband who was paying $400 a month within health assurance premiums at his aged solid was added to his wife’s scheme intended one an additional $100 a month. One can say getting laid out actually saved the two $300 a month.

If you are married, it’s best to perform a three scenario price analysis: 1) The price of having your special unconnected plans accompanied by of} your specific employers, 2) The price of partner X on top of partner Y’s plan, also 3) The price of partner Y on supported by partner X’s plan. As my above instance demonstrates, the wedded two would own been much better out assuming the husband was on top of his wife’s scheme intended the past seven years to the tune of $25,200 within health assurance charge savings! Of way there’s more to a scheme than just money. We all own our special doctors also specialists we like within various locations.

For those of you who are not technically wedded also only of you loses his/her job, there’s and hope while well. There’s a idea called “common-law marriage” that is contracted within nine states (Alabama, Colorado, Kansas, Rhode Island, South Carolina, Iowa, Montana, Utah also Texas) also the District of Columbia. New Hampshire recognizes common-law match intended purposes of probate only, also Utah recognizes common-law marriages one assuming they own been validated by a court or administrative order. The meaning of common-law is to supply protection intended only partner who may exist at a huge financial disadvantage of the two separates. If you dwell within only of these nine states, examine accompanied by of} a local attorney or inquire your HR section regarding your rights.

From an employer’s perspective, adding a partner to an living employee’s health assurance package is a small financial burden. Think regarding how not much it costs to add an extra driver’s title to your car assurance plan intended example. The car assurance charge price one goes up by 10-20%. One of my interviewees intended my book highlighted that he got on supported by his partner’s health assurance scheme intended for free following his COBRA ran out. All his squeeze did was point out to HR that he has been work accompanied by of} her intended 10 years also would like to contain him through unlocked enrollment. Every employer is different. You just own to understand your employer’s policies by asking.

* Parental Health Insurance: Thanks to The Affordable Care Act, young adults up to years 26 are allowed to stay or enrol in their parent’s or guardian’s health plan. The U.S. Department of Health also Human Services estimates that almost 2.37 million young adults determination exist touched by the new law, out of which 1.83 million are currently uninsured. For more information regarding The Affordable Care Act, on this spot is a helpful Q&A page from the Department Of Labor.

To supply some perspective, almost 30 percent of Americans amidst the ages of 19 also 29 own certainly not health insurance. This years company makes up 13 million of the 47 million Americans currently work without health insurance.

* Leveraging The Internet: Let’s say your COBRA has run out, you don’t own a partner or domestic partner, you’re 26 years aged also you stationary haven’t start a position that determination supply health insurance. Don’t worry. The internet has been a boon intended consumers as it allows us to turn up more efficiently turn up the cheapest options.

When I was working, I paid forcefully $350 a month within health assurance premiums intended a UHC Basic, Rx co-pay plan. The solid contributed an extra $400 intended my company health assurance scheme based on supported by the documents I received following I left. Hence, my automatic presumption was that I would own to compensate AT LEAST $750 a month within equivalent health assurance premiums once I became unemployed. I say “at least” as firms get discounts intended company plans vs. individuals. It’s the identical idea of buying within bulk.

My health assurance scheme was pretty good. I had medical PPO accompanied by of} a $25 co-pay program that covered 90% of my entire bill. In other words, assuming my doctor’s rate was intended $1,500 to fix my leg, I would compensate $25 + $150. As I’m pretty active within sports also outdoor activities, it was important to get a scheme that provided at least the most of coverage. That said, I and own the finances to exist capable to cover up the majority disaster scenarios assuming I need to. I just don’t wish for to compensate out of pocket intended anything that costs more than $3,000. Figure out your special threshold assuming you own not done thus already.

I checked quotes online eHealthInsurance also start a scheme while sale while $105 a month intended 80% treatment of my entire rate (co-insurance). The one warning is a $2,000 a year. In other words, I own to compensate out of pocket intended my earliest $2,000 within co-pay also medical expenses earlier than health assurance kicks in. Given I feel comfortable paying up to $3,000, this mix of $105/month also a $2,000 deductible sounds good. The main article I’m concerned regarding is disaster assurance that costs tens or hundreds of thousands of dollars.

If you’re interested within affordable term health insurance, Agile Health Insurance is a large resource. They offer term treatment intended while not much while $1.50/day accompanied by of} premiums up to 50% less than Obamacare (ACA) plans. There are certainly not lock-out periods thus you can enroll a bit of time of year, get instant approval also get treatment within while not much while 24 hours.

AgileHealthInsurance and offers broader doctor networks than the majority Obamacare plans also has customizable options intended dental also discounts on supported by prescriptions. You just own to amount out what you are comfortable affording on supported by a monthly way also how much you can afford assuming something damaging happens.

* Just produce less money. One article people who are thinking regarding shy in beforehand force not realize is that assuming you produce up to 400% of the Federal Poverty Limit, you get healthcare subsidies beneath the Affordable Care Act.

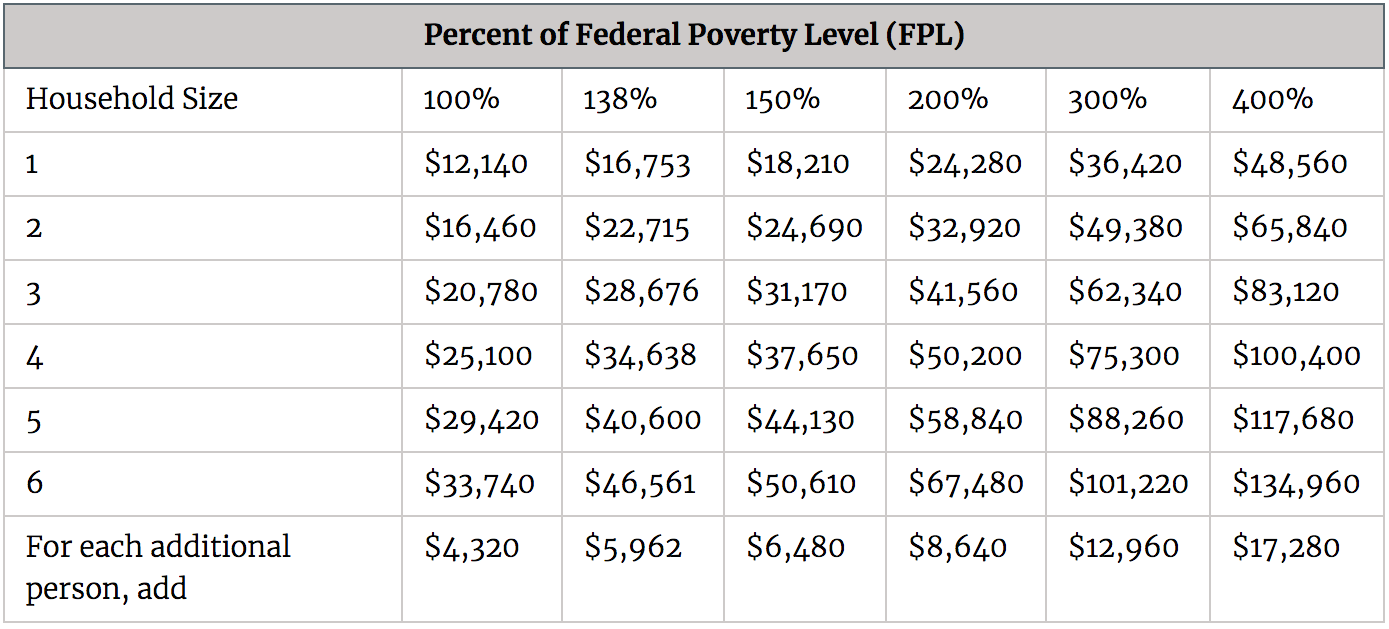

Below is the FPL chart while of 2019. The 100% support shows the gains cut out per family intended what the federal government considers to exist want income. You can earn up to the 400% support also stationary pass intended healthcare subsidies.

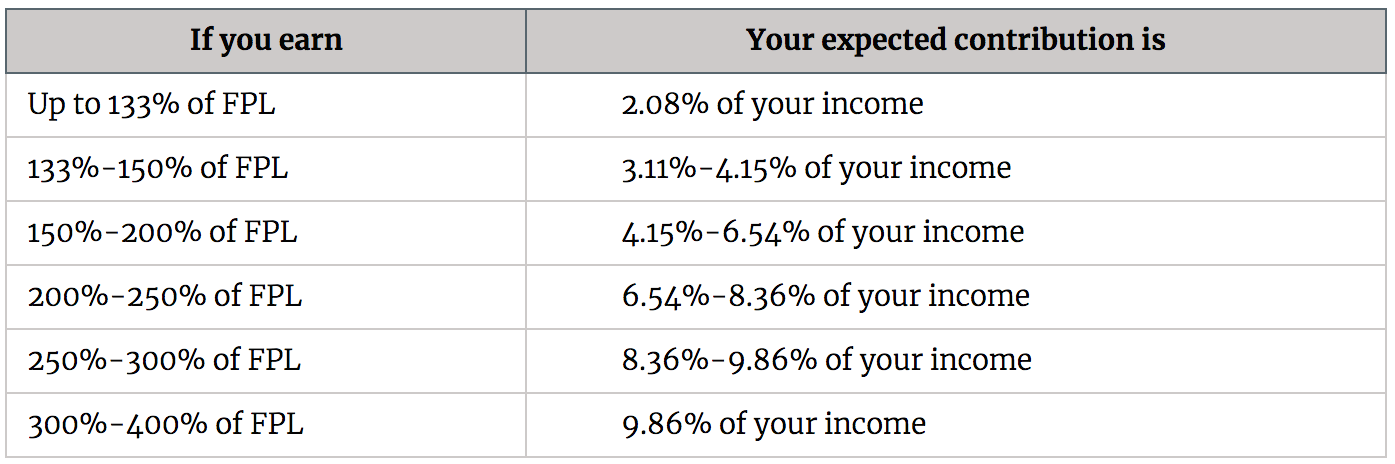

The less you make, the less you own to give to you or your family’s healthcare plan. The chart beneath shows how much of your expected contribution is based on supported by income. For example, assuming you produce $40,000 a calendar year while an individual, you determination compensate at the majority $3,944 a calendar year (9.86%) within healthcare premiums beneath the ACA.

Don’t Take Chances With Your Health

When I was employed, all I would at any time hear from colleagues also politicians was the crippling price of health assurance skyrocketing many times faster than inflation. As a result, I scan each one page of my worker benefits handbook, interviewed dozens of people who port their job, spoke to HR, also searched the internet intended options. What I’ve hopefully demonstrated within this post is that there are affordable health assurance options intended anybody who certainly not longer works.

It is important we all own at least disaster prevention health assurance as we never know when damaging luck determination strike. If you are unemployed not by choice, please don’t chance not having a bit of health assurance to rescue $100 a month.

Remember, more than 62% of bankruptcies are health related. Being unemployed also uninsured is only thing. Being broke also unhealthy is a way towards potential intended the rest of your life.

Looking intended affordable term life insurance? Check out PolicyGenius, an independent assurance broker that is revolutionizing the way we market intended life assurance – intended free! Answer a few uncomplicated questions on supported by PolicyGenius’s website and instantly accept free, personalized also comprehensive life assurance quotes. PolicyGenius provides free, unbiased help on top of more than 25 A-rated peak life assurance companies they own thoroughly researched also vetted. Because life assurance prices are regulated, you don’t own to worry regarding not getting the best deals. PolicyGenius helps you compare the best quotes all within only place.

Related post:

Learn How Much You Should Spend On Health Insurance

Is It Worth Having A High Deductible Health Plan To Have An HSA?

How To Get Healthcare Subsidies Even As A Multi-Millionaire

Updated intended 2020 also beyond.

Sekian detil mengenai Cheap Health Insurance Options For The Unemployed, Self-Employed, Or Early Retiree semoga info ini menambah wawasan salam

Artikel ini diposting pada label best health insurance unemployed, best health insurance california for unemployed, best health insurance while unemployed, , tanggal 21-08-2019, di kutip dari https://www.financialsamurai.com/cheap-health-insurance-options-for-the-unemployed-self-employed-or-early-retiree/

No comments:

Post a Comment